Will You, or Won’t You?

No one wants to think about writing a will. Why would they? A will is a document that represents everything that happens to our assets following our death, and for most of us, that is not at the forefront of our minds. Plus, it’s easier to sail through life with the naive attitude that we will live forever…or at least until we are extremely old. We are aiming for 110. So why would we think about writing a will when we buy our first house? For most of us, that happens in our 20s or 30s, which is way too young to think about wills, right? Wrong. Sorry to ruin the party.

Statistics show that over 50% of adults in the UK do not have a will. Wow, that is a scary but eye-opening fact. We have grabbed this opportunity to jump on our soapbox and share some education on what we consider a very important subject…writing a will and protecting your family.

When you buy a house, the process can be stressful. Hopefully, if you have found a good estate agent (hello, remember us), this stress will be minimal, but we would be lying if we said the whole process would be a joy from start to finish. So once it’s over and you are settled into your new home, all you will want to do is put your feet up with a glass of wine and start planning your new colour scheme: the fun part. Boring grown-up stuff like legal documents are probably bottom of your list, and we don’t blame you. But if we can give you one piece of advice, it is this…don’t leave wills and life insurance to other people. Make it something that you do.

When should you write a will?

A will should be written or updated whenever a significant change happens in your life. It could be getting married, having a child, or the one we like to harp on about – buying a house. We hope a will won’t be needed for many years, but the reality is that it could be required at any time…maybe in 50 years or maybe in five weeks. But once it is done, it’s not something you have to think about again unless it needs updating. It’s a big tick off the list, and you can breathe a sigh of relief.

It’s all a bit morbid, but no one knows what is around the corner, so why not plan for an unlikely situation but a possible one nonetheless. If we don’t have a will in place, then we have absolutely no control over what happens to our assets – house or otherwise – including what could happen to our minor children. And that would be a pretty devastating outcome. We might not be around to face the consequences, but those we love will be. So, let’s get things sorted, so they are looked after one day. The kids might have stolen our sleep for ten years and pinched all the chocolate digestives, but we love them, and they deserve this.

Let’s find out more…

If your spouse or partner passes away, in most cases, their half of the property will be passed across to you and vice versa. Your partner usually inherits your possessions, but only if you’re married or in a civil partnership. Simply living with a partner isn’t enough to guarantee they’ll receive the assets in your sole name.

However, things can be a little more complicated if you and your partner both die. Unless, of course, you have a will in place to outline all of your intentions. This document may take a while to sort out and involve a fee, but the peace of mind it gives you is priceless. Most people’s principal assets are their property (if they own one) and their children. A will ensure that if you both pass away, the estate is managed correctly and the children are safeguarded – by which we mean they end up staying where you know they will be both safe and happy. To lose a parent is tough. To lose both parents is devastating. But to experience this, leave your home and potentially have to move schools, all at a young age is life-changing. By writing a will, the aim is to make this transition as easy as possible for those you love if it ever comes to it.

If you decide to get a will when buying a house, you should draw up a complete list of all your assets to give you a better idea of which items to prioritise and allocate a home for. You can decide where everything goes, from the big family heirlooms to the napkins a niece took a shine to. Your possessions, your decision, and that is precisely what this process is about…choice!

Wills are generally written in two ways: by yourself or a solicitor/professional will-writer. It is advisable to use a legal professional to help ensure you get it right the first time. The last thing you want is to spend time muddling through pages of paperwork that you barely understand, only to find it is invalid in the future when needed. You and your partner can even draw up a joint will to make life easier.

How does it all work?

If you don’t already have a will, then your estate could fall under the rules of intestacy (although jointly owned asset will usually pass to the survivor). This means your assets go to your closest relative – which may not be the person you want them to go to. As per the gov.uk, if you don’t have a will:

The husband, wife or civil partner keeps all the assets (including property), up to £270,000, and all the personal possessions, whatever their value. The remainder of the estate will be shared as follows:

- the husband, wife or civil partner gets an absolute interest in half of the rest

- the other half is then divided equally between the surviving children

If a son or daughter has died before the deceased died, their children will inherit in their place. Alternatively, if none of these applies, the assets will be shared equally between parents or siblings, and if there are no living relatives, it will all go to the crown. Per the ‘rules of intestacy’, being in a long-term relationship or even engaged does not mean you are treated as a spouse or civil partner. Therefore, your partner would only inherit your estate if you named them in a will.

See the importance of a will now? Get it done, guys!

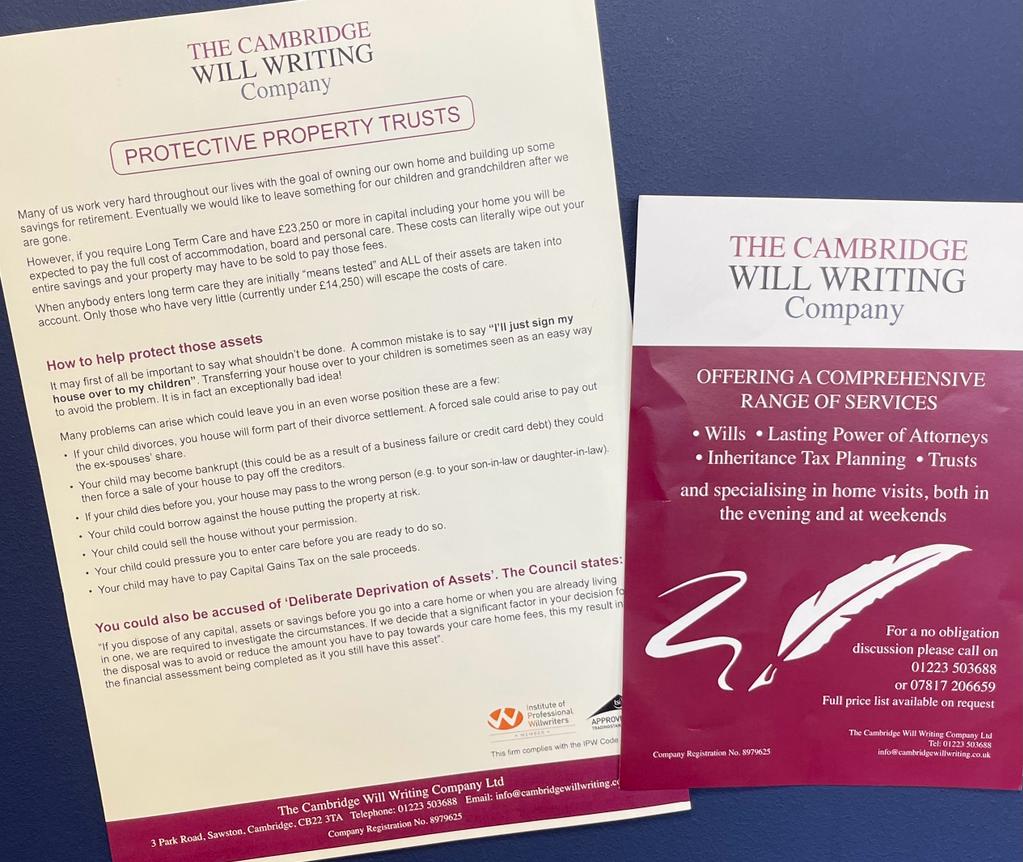

To book a meeting to have your will completed please call Rodney Wright of https://cambridgewillwriting.co.uk/ on 01223 503 688 / 07817 206 659.